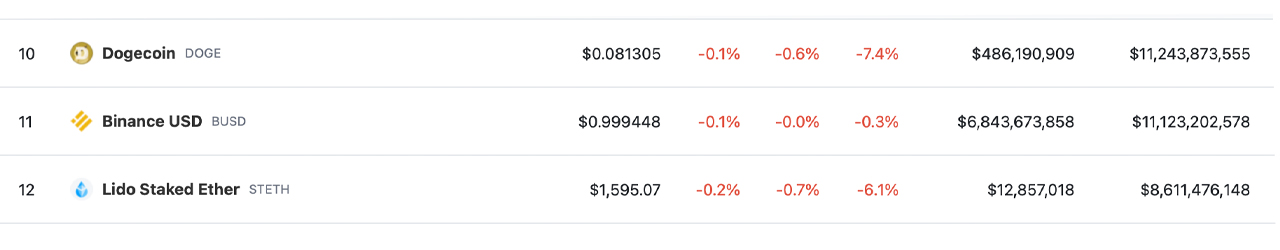

After Paxos announced that it would no longer mint the stablecoin BUSD, 4.98 billion BUSD stablecoins have been removed from circulation to date. The Paxos-managed stablecoin has also fallen out of the top ten crypto assets by market capitalization, slipping below dogecoin’s valuation with a market cap of around $11.12 billion, compared to the meme coin’s $11.24 billion.

BUSD Redemption: Almost $5 Billion Worth of Stablecoins Removed from Circulation in 12 Days

Since Paxos announced on Feb. 13, 2023, that it would no longer issue the dollar-pegged crypto asset BUSD, nearly $5 billion worth of BUSD stablecoins have been redeemed. At the time of the announcement, there were approximately 16.1 billion BUSD coins in circulation, but today there are around 11,129,348,406 BUSD circulating. Throughout the past 12 days and the redemption of 4.98 billion BUSD, the dollar-pegged crypto asset has remained at parity with the U.S. dollar.

On Feb. 25, 2023, Binance’s reserve portfolio showed that the crypto exchange held $9.01 billion in BUSD. Globally, BUSD had a 24-hour trade volume of around $6.84 billion, with Binance being the most active BUSD exchange, according to coingecko.com stats. The majority of BUSD trades were paired with the stablecoin tether (USDT), while the Turkish lira still accounted for 2.80% of all BUSD trades on Saturday.

Currently, out of the $1.1 trillion crypto economy, BUSD accounts for 1.007% of the aggregate value. That dominance has decreased significantly over the past 12 days, and BUSD was officially removed from the top ten crypto coin positions this weekend. As of writing, BUSD is the 11th largest market valuation out of the thousands of crypto assets in existence, with a market cap below dogecoin (DOGE) and above lido staked ether (STETH).

What do you think about the nearly $5 billion worth of BUSD stablecoins redeemed over the past 12 days, causing the asset to drop from the top ten positions? Share your thoughts on this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

<< Den vollständigen Artikel: BUSD Stablecoin Drops from Top 10 Crypto Assets Amid Significant Decrease in Dominance – Altcoins Bitcoin News >> hier vollständig lesen auf news.bitcoin.com.